How to Start Saving for College: A Parent’s Guide

Many parents wonder when and how to begin saving for college. Whether your child is in preschool or approaching middle school, the sooner you start planning, the better prepared your family will be.

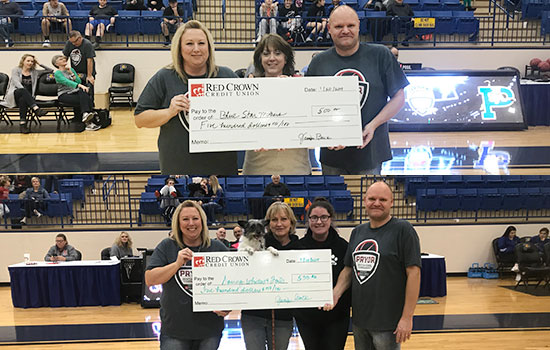

At Red Crown Credit Union, we help Oklahoma families create smart, achievable college savings plans. Use this guide to help you begin building a financial foundation for your child’s future education.

Set a Realistic College Savings Goal

Before opening a college savings account, ask yourself: What kind of school do you see your child attending? In-state public universities, out-of-state schools, and private colleges all have very different tuition costs.

Do some research on the typical costs of each. This will help you set a realistic savings goal and stay on track as you work toward it. You can find our investment rates here.

Add a monthly cut to your budget

Once you’ve set a goal, divide that number by the number of years left until your child starts college. Then break it down further into monthly contributions. This makes the goal more manageable and helps you stay consistent.

Even if you can’t save the full amount each month, saving regularly builds momentum. Consider setting up automatic deposits or using a budget app to stay accountable.

Understand Financial Aid Options

Financial aid — including FAFSA (Free Application for Federal Student Aid) — can significantly reduce out-of-pocket college expenses. While aid amounts depend on factors like household income, there are also many scholarships and grants available.

Start early by researching opportunities from your school district, community organizations, and your child’s intended colleges. Every bit helps — and some don’t require repayment.

Don’t Sacrifice Retirement for College

Nearly 1 in 3 parents with student debt say they’re prioritizing college savings over retirement. While it’s natural to want to protect your child from debt, sacrificing your retirement can put you at risk later in life.

Student loans are available for college — but there are no loans for retirement. Strike a balance that protects your long-term well-being, too.