Picking the Right Car for You

As a first-time car buyer, it wasn’t easy to pick the perfect vehicle… or even know where to start. I quickly learned that five key components helped me dictate my car-buying process.

Finances

A car can be an expensive purchase. This is why your finances must take the lead in your decision-making. Ask yourself some questions:

- What is the largest down payment I can make to reduce monthly costs?

- What is my ideal monthly payment and interest rate?

- How much will the extra factors such as gas, insurance, maintenance, and registration cost on top of the car’s base price?

Car ownership is more than just the base car price.

Day-to-Day Commute

We each have a unique commute. Some of us drive 30 minutes daily, and some drive over 2 hours. Our commutes are unique, and we must find a vehicle that matches what we must do every day. Here are some things to consider:

- Travel Time

- Fuel Efficiency

- Terrain

- Storage Capacity

- Passengers

Comfort

Regardless of our commute, we can all agree that comfort is necessary in a vehicle. We must ask ourselves if we feel comfortable behind the wheel of each car we test drive.

- Do you feel cramped?

- Can you understand the technology?

- Do you feel too high or too low on the ground?

- Can you get in and out without trouble?

- Is it easy for you to access your storage space?

Each of these seems small, but they are often overlooked. Why would we want a car that we don’t feel good in?

In addition to considering your own commute, how about your children or pets? How would the vehicle you choose benefit them or hinder their day-to-day lives?

Wants and Needs

One of the most exciting but challenging parts of car buying is understanding what you want and need.

Wants can look like this:

- Heated Seats

- Push Start

- Sunroof

- Fully Digital Screens

Needs can also look like:

- Heated Seats

- Push Start

- Sunroof

- Fully Digital Screens

In my car-buying process, I realized that each person’s wants and needs can differ. I work in an office with a ten-minute commute, all on city streets. I may want a 4WD vehicle, but I don’t need it. However, some of my coworkers travel further distances where their commute involves dirt and gravel roads. They may require a 4WD vehicle.

This is where you decide what you value most and what your budget can afford.

New or Used

After considering the above, you must also decide if you want a new or used vehicle.

New is nice and feels like a fresh start, but used can be more affordable.

Typical concerns with used vehicles include a messy title, lack of maintenance, and a dishonest dealer.

Whether the car you buy is new or used, ALWAYS ask for the records. You will thank me later.

With these five key components, I hope you can narrow your vehicle selection to one that fits you perfectly. But what’s next?

We go back to component #1 – finances.

You have determined a down payment. You have assessed your income and what you are willing to pay.

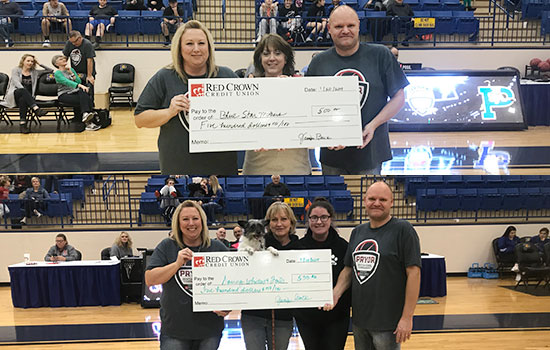

Now, find the best APR to finance. You can apply at multiple banks, but save yourself the hassle and let us take care of it. Red Crown Credit Union currently offers rates as low as 7.49% APR* on all new/used/pre-owned vehicles.

Visit redcrowncu.org for Rates and Fees, or stop by any of our five Red Crown locations and learn more about getting into your new vehicle with peace of mind.

*Annual Percentage Rate (APR) is based on your individual credit history with approved credit. APR may vary. Rates are subject to change without notice.